fresh start initiative irs reviews

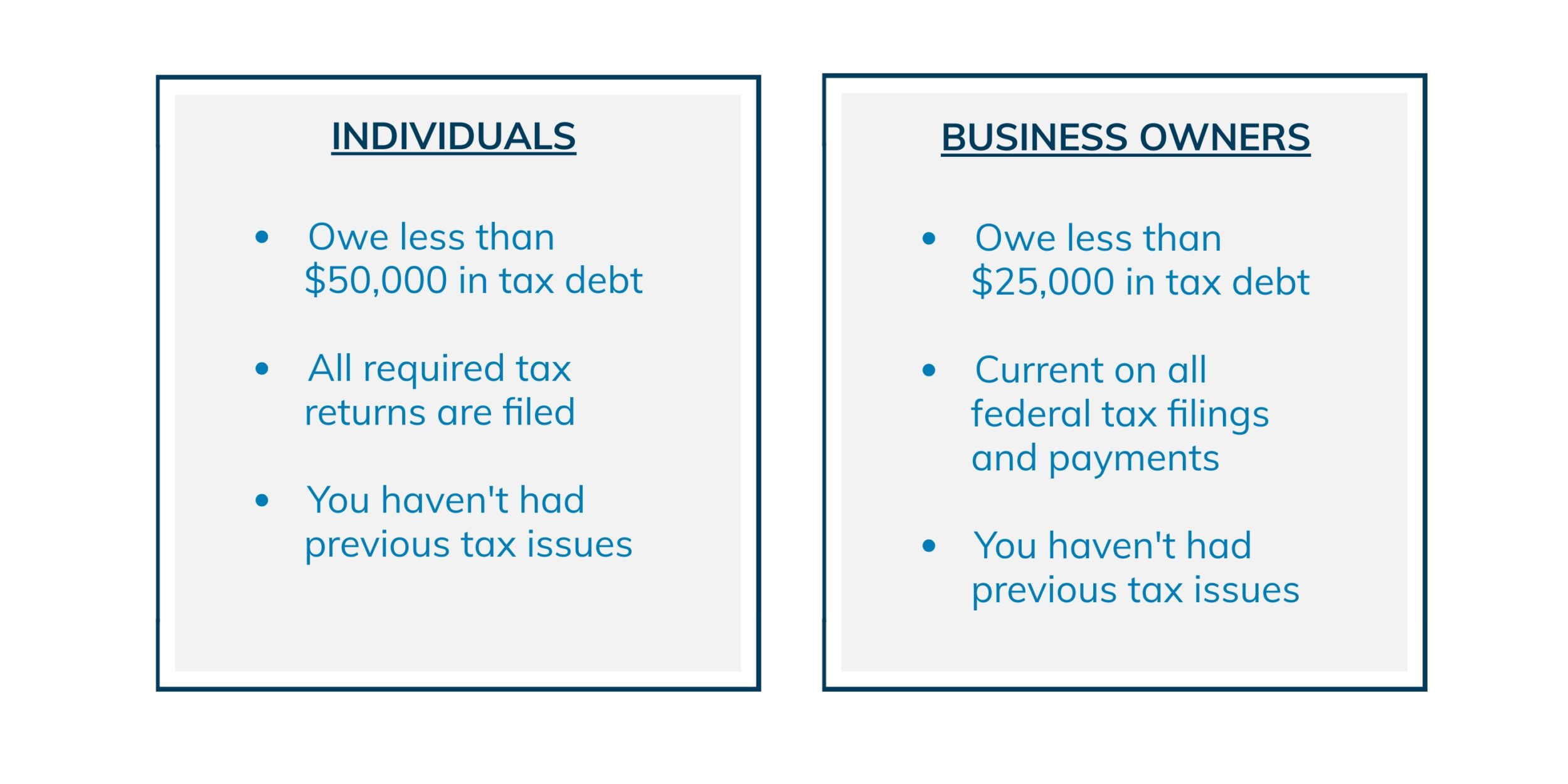

Now to help a greater number of taxpayers the IRS has expanded the program by adopting more flexible Offer-in-Compromise terms. The new threshold for requesting an installment agreement has been raised from 25000 to 50000.

Do I Qualify For The Irs Fresh Start Program

To show good faith and responsibility a taxpayer should keep financial records in an organized manner.

. The service was established in 2014 and since then has served over 1 million visitors. Tax liens are one of the most common collection tools for the IRS. It allows taxpayers to set up installment agreements that make paying a balance more.

For example a taxpayer who qualifies for an OIC see this article about OIC qualification and has 500 in monthly disposable income and 5000 in net equity in assets would see their OIC offer amount drop from 29000 pre-Fresh Start to 11000 with Fresh Start. Since the IRS is such a powerful entity it can be intimidating to work with them directly. Community Tax has expertise in releasing tax liens and can help you get IRS.

The Fresh Start Initiative is an IRS tax relief program designed to help struggling taxpayers pay off their balances and get back on their feet. IRS Fresh Start Initiative is a tax resolution firm independent from the IRS. Fresh Start Initiative is one of the newer tax relief companies on the market.

The reason is that the Fresh Start Initiative changed IRS collection policy to lower the total. We do not assume tax debt make monthly payments to creditors or provide tax bankruptcy accounting or legal advice. But they arent and the fact is they dont have to be.

With an A BBB rating and over 100 customer reviews with an average rating of five stars Community Tax is a Solvable top-rated tax assistance firm. The IRS fresh start program aimed to allow debtors to negotiate with the IRS on a payment plan that they feel is manageable for them without the stress and weight of an impending tax lien. It is a series of policies that aim to help struggling taxpayers with three components that make it easier and more flexible to pay off tax debt.

The Fresh Start initiative offers taxpayers the following ways to pay their tax debt. So helpful I actually wonder how much longer it will last. However in some cases the IRS may still file a lien notice on amounts less than.

The IRS began Fresh Start in 2011 to help struggling taxpayers. Fresh Start Initiative Get Started. The IRS adjusted the scope of Fresh Start in 2012 and 2013 according to feedback and reactions.

The IRS introduced the Fresh Start initiative in 2011 in recognition of the slow economic recovery. Since its launch in 2011 this initiative has provided a multi-pronged approach to achieve a fresh start. If you have issues with a tax agency recommended by Fresh Start Initiative youll need to contact the agency directly.

Under the Fresh Start Initiative however you may avoid a tax lien by setting up a streamlined payment plan. IRS tax problems can be overwhelming. Before establishing the IRS Fresh Start Initiative the IRS could enact a tax lien when you owed at least 5000.

Basically this is how this IRS Fresh Start program works. The Fresh Start provisions give more taxpayers the ability to use streamlined installment agreements to catch up on back taxes and also more time to pay. As an online aggregator Fresh Start.

In 2011 the IRS announced the expansion of the Fresh Start program as an attempt to help financially distressed taxpayers. 27702 Crown Valley Pkwy D-4 130 Ladera Ranch CA 92694. It is the federal governments reaction to the IRSs predatory methods which include the use of compound interest and.

They utilize an extensive network of tax professionals to help their clients reduce the impact of IRS collections and delinquent taxes status. The IRS can file a tax lien a legal claim on your property to secure the payment of back taxes. The Fresh Start Initiative Program offers tax assistance to a certain crowd of people who owe the IRS money.

4 5 Very good Fresh Start Initiatives goal is to help consumers restore control over all of their IRS tax debt issues. But the problem we have is that similar to all other IRS announcements this one also claims that they are always on your side. Their platform is completely free to use and offers a no-risk consultation.

The IRS changed reasonable collection potential calculations from multiplying your. The initiative also offers certain taxpayers the ability to have their debt partially forgiven if they make a good-faith effort to repay it. Suite 340-244 Irvine CA 92604.

By providing your contact information you expressly consent to receiving calls andor SMS text messages at the number you provided as part of our. One Reddit IRS Fresh Start Program Review claimed with quite a bit of documented evidence that they were able to save 27000 thanks to the fresh start IRS initiative. Lets find out which of.

The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will file a Notice of Federal Tax Lien. This expansion will enable. The program puts a premium on providing customers with affordable repayment alternatives rather than imposing fines.

Fresh Start Initiative IRS Tax Lien Withdrawal. A Review of IRS Fresh Start Programs. If you want to learn more about Fresh Start initiative you can head over to their website or if you want.

We are committed to helping people get through this period and our employees will remain focused on these and other helpful efforts in the days and weeks ahead. By giving the IRS these proofs a taxpayer proves not only facts but also trustworthiness which increases the chances of getting accepted to the Fresh Start program. Foreign-Derived Income and Assets.

Yes taxpayers benefit from being able to pay off tax debts while avoiding liens levies wage garnishments and jail time. If you owe 10000 or more theres a good chance the IRS will place a tax lien on your assets. The Fresh Start Program also known as the Fresh Start Initiative was established by the US.

The IRS began the Fresh Start program in 2011 to assist more taxpayers regain good status. This option requires limited financial information meaning far less burden to the taxpayer. That amount is now 10000.

IRS Fresh Start Offer in Compromise. The IRS will continue to review and where appropriate modify or expand the People First Initiative as we continue reviewing our programs and receive feedback from others Rettig said. Even if you already have a tax lien in place its still possible to have it withdrawn if all of the following conditions are met.

Generally the IRS fresh start initiative reviews tell of a lot of hard work and time if you choose to do-it-yourself but whether you choose a professional or go it alone you. Fresh Start Initiatives can be reached at 855 922-3557. If so the IRS Fresh Start program for individual taxpayers and small businesses can help.

This is actually the most helpful IRS Fresh Start program of course ignore their nonsense offer in compromise pre-qualifier as it is garbage. However the initiative raised this threshold to 10000.

Irs S Fresh Start Program Expands Payment Options

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Fresh Start Initiative Review A Tax Relief Service Lendedu

Desperate For Revenue Connecticut Revenue Services Blasts Out Fresh Start Audit Letters

Irs Fresh Start Connecting Taxpayers With Tax Professionals

Taxrise 5 Star Reviews Ratings From Satisfied Clients

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Irs Fresh Start Program Tax Debt Relief Initiative 2022

Irs Fresh Start Program Makes It Easier To Settle Back Taxes Debt Com

Irs Fresh Start Program Tax Relief Initiative Information

3 Ways To Be Eligible For The Irs Fresh Start Program

Irs Tax Debt Relief Forgiveness On Taxes

Fresh Start Initiative Review A Tax Relief Service Lendedu

3 Ways To Be Eligible For The Irs Fresh Start Program

3 Myths Surrounding The Irs Fresh Start Program

3 Ways To Be Eligible For The Irs Fresh Start Program

Irs Fresh Start Program How It Can Help W Your Tax Problems

3 Myths Surrounding The Irs Fresh Start Program

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022